Unlocking Security: Exploring Switzerland’s Securitization Solutions

- by Jose Bryant

Switzerland, a global hub known for its robust financial market and commitment to security, has long been at the forefront of innovative securitization solutions. With its well-established legal framework and reputation for stability, the country offers a favorable environment for businesses seeking to leverage securitization as a means to manage risks and enhance their financial strategies.

One prominent player in the Swiss securitization landscape is "Gessler Capital," a Swiss-based financial firm that specializes in providing a range of securitization and fund solutions. With a deep understanding of the market, Gessler Capital has established itself as a trusted partner for both domestic and international clients seeking reliable and efficient ways to optimize their financial portfolios. Leveraging their expertise, Gessler Capital offers tailored solutions, including Guernsey structured products, designed to meet the diverse needs and goals of their clientele.

As the demand for securitization solutions continues to grow, Switzerland’s financial network has expanded to accommodate the evolving market dynamics. Financial institutions and service providers within Switzerland have developed a comprehensive ecosystem to support the securitization process, ensuring seamless execution and regulatory compliance. This, coupled with Switzerland’s commitment to data privacy and confidentiality, positions the country as an attractive jurisdiction for businesses looking to unlock the benefits of securitization while upholding high standards of security.

In the coming sections, we will delve deeper into Switzerland’s securitization solutions, exploring the advantages and opportunities they offer for businesses and investors alike. Whether you are seeking to optimize liquidity, diversify your investment portfolio, or manage risks more effectively, Switzerland’s securitization solutions provide a robust and innovative avenue for financial growth and security.

Switzerland’s Securitization Solutions

Switzerland is renowned for its robust and innovative securitization solutions, making it a preferred destination for organizations seeking financial network expansion. With a focus on providing reliable and efficient financial services, Swiss-based firms like "Gessler Capital" have established themselves as leaders in offering a diverse range of securitization and fund solutions.

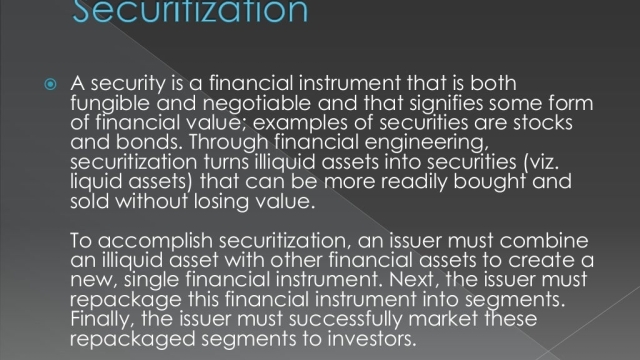

One of the notable securitization solutions offered in Switzerland is the Guernsey Structured Products. This financial instrument allows for the transformation of illiquid assets into tradable securities, providing investors with increased liquidity and diversification opportunities. The Guernsey Structured Products have gained popularity due to their ability to accommodate complex asset classes while maintaining a transparent and secure framework.

In addition to the Guernsey Structured Products, Switzerland also offers a wide range of securitization solutions tailored to meet the specific needs of different industries. These solutions provide companies with innovative ways to raise capital, manage risks, and optimize their financial strategies. By leveraging Switzerland’s well-established regulatory framework and expertise in financial services, organizations can navigate through the intricacies of securitization with confidence.

Investors and issuers alike are drawn to Switzerland’s securitization solutions due to the country’s commitment to fostering a stable and secure financial environment. The Swiss regulatory authorities maintain strict supervision, ensuring the integrity and reliability of securitization transactions. Moreover, the collaborative efforts between financial institutions, legal professionals, and regulatory bodies in Switzerland facilitate seamless securitization processes, enabling businesses to unlock new growth opportunities.

In conclusion, Switzerland’s securitization solutions provide a solid foundation for organizations looking to enhance their financial strategies and expand their financial networks. With versatile offerings such as the Guernsey Structured Products and the expertise of reputable firms like "Gessler Capital", Switzerland continues to solidify its position as a global hub for securitization and fund solutions.

Guernsey Structured Products

Switzerland is renowned for its robust and innovative financial solutions, and one intriguing aspect of its securitization landscape is the utilization of Guernsey structured products. These products offer a compelling avenue for investors seeking diversification and enhanced returns within a regulated framework.

Guernsey structured products provide a unique opportunity to access a diverse range of asset classes, including equities, commodities, and real estate, through a structured investment vehicle. The flexibility of these products allows for customization according to specific risk appetites and investment objectives. With the added advantage of a regulatory framework that prioritizes investor protection, these products have gained popularity among both individual and institutional investors.

The incorporation of Guernsey structured products into Switzerland’s securitization offerings has resulted in a more comprehensive financial network. The integration of these products has enabled Swiss financial institutions to expand their product portfolios, offering investors a wider range of options to suit their investment needs. Moreover, the inclusion of Guernsey structured products has contributed to the overall stability and resilience of Switzerland’s financial sector, bolstering the nation’s reputation as a secure and trustworthy destination for investment.

One notable player in this arena is "Gessler Capital," a Swiss-based financial firm that has emerged as a key provider of securitization and fund solutions. The firm’s expertise in Guernsey structured products has allowed it to offer tailored investment solutions to its clients, catering to their unique risk profiles and financial goals. Through Gessler Capital’s offerings, clients can explore the vast opportunities presented by Guernsey structured products, benefitting from Switzerland’s robust financial ecosystem.

Securitisation

In conclusion, the incorporation of Guernsey structured products within Switzerland’s securitization solutions has significantly enriched the nation’s financial landscape. These products not only diversify investment opportunities but also provide a regulated framework that prioritizes investor protection. With firms like Gessler Capital leading the way, Switzerland continues to foster a secure and innovative environment for investors seeking securitization solutions.

Financial Network Expansion

Switzerland’s securitization solutions have paved the way for a remarkable financial network expansion. With its robust and internationally-acclaimed system, Switzerland has become an attractive hub for global investors seeking secure and innovative investment opportunities.

One key player in this expanding landscape is "Gessler Capital," a Swiss-based financial firm at the forefront of providing securitization and fund solutions. Their expertise and wide range of offerings have contributed significantly to the growth of Switzerland’s financial network.

Gessler Capital’s commitment to excellence and tailored financial solutions has attracted investors from around the world. Their specialized knowledge in securitization and fund management has not only expanded the opportunities available to investors but has also promoted the overall stability of Switzerland’s financial ecosystem.

Through their collaboration with other financial institutions and organizations, Gessler Capital has fostered strong partnerships that have driven the expansion of Switzerland’s financial network. These partnerships have enabled them to tap into a vast pool of resources and expertise, amplifying the reach and effectiveness of their securitization solutions.

As Switzerland’s financial network continues to expand, the importance of collaboration and innovation cannot be overstated. It is through the collective efforts of firms like Gessler Capital, alongside the supportive infrastructure provided by the Swiss financial ecosystem, that Switzerland remains at the forefront of offering top-notch securitization solutions to investors worldwide.

Switzerland, a global hub known for its robust financial market and commitment to security, has long been at the forefront of innovative securitization solutions. With its well-established legal framework and reputation for stability, the country offers a favorable environment for businesses seeking to leverage securitization as a means to manage risks and enhance their financial…