The Essential Guide to Navigating Car Insurance: Protecting Your Ride and Your Wallet

- by Jose Bryant

Car insurance is a vital aspect of owning and operating a vehicle, providing protection for both your beloved ride and your hard-earned money. But for many, navigating the world of car insurance can be daunting and overwhelming. It’s important to understand the ins and outs of this essential coverage to ensure you make informed decisions that meet your specific needs.

So, what exactly is car insurance? Put simply, car insurance is a contract between you and your insurance provider that offers financial protection in the event of accidents, collisions, theft, or other damages to your vehicle. By paying regular premiums, you transfer the risk of potential costs to the insurer, allowing you to drive with peace of mind knowing that unforeseen circumstances won’t drain your wallet.

With numerous insurance options available, selecting the right car insurance policy can seem like a complex puzzle. Factors such as coverage levels, deductibles, and premiums all come into play. By understanding the key components and terms associated with car insurance, you’ll be better prepared to make educated choices that align with your unique needs and circumstances.

In this comprehensive guide, we’ll explore the essential aspects of car insurance, debunk common myths, demystify confusing jargon, and provide practical tips to help you protect your ride and your wallet. By the end, you’ll feel confident and empowered to navigate the world of car insurance, allowing you to hit the road with the peace of mind you deserve. So, let’s dive in and unravel the intricacies of car insurance together.

Understanding the Basics of Car Insurance

Car insurance is a vital component of owning and driving a vehicle. It provides financial protection in case of accidents, theft, or damage to your vehicle. Understanding the basics of car insurance is crucial for all drivers to ensure they have the right coverage to protect themselves and their vehicles.

First and foremost, it’s important to know what car insurance is. Car insurance is a contract between you and an insurance company. In exchange for paying a premium, the insurance company agrees to provide coverage for certain risks associated with owning and driving a car. This coverage can include liability coverage, which pays for damages or injuries caused to others in an accident you are responsible for, as well as coverage for damage to your own vehicle.

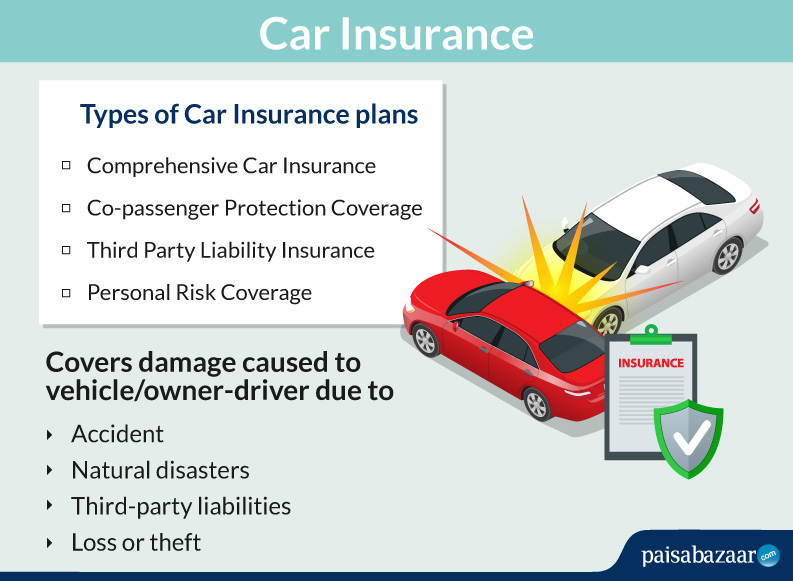

There are various types of car insurance coverage available, and it’s essential to choose the right ones for your needs. Liability insurance is typically required by law and provides coverage for injuries or damages to others in an accident. Collision coverage pays for repairs or replacement of your vehicle if it is damaged in a collision, regardless of who is at fault. Comprehensive coverage protects against damage to your vehicle from non-collision incidents such as theft, vandalism, or natural disasters.

Having a good understanding of the basics of car insurance empowers you to make informed decisions to protect your ride and your wallet. By knowing what car insurance is, the different types of coverage available, and how they work, you can ensure you have the right insurance policy in place to provide you with the necessary protection on the road.

Types of Car Insurance Coverage

When it comes to car insurance, there are various types of coverage options to consider. Each type offers different levels of protection for your vehicle and your pocket. Understanding these options can help you choose the right coverage for your needs. Let’s take a closer look at some of the common types of car insurance coverage.

Liability Coverage: Liability coverage is the foundation of most car insurance policies. It helps protect you financially if you are at fault for causing an accident. This coverage typically includes two parts: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and legal fees associated with injuries or death caused to others in an accident. Property damage liability covers the cost of repairing or replacing someone else’s property, such as their vehicle or any structures that were damaged in the accident.

-

Collision Coverage: Collision coverage provides financial protection for damages to your own vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. This coverage helps cover the cost of repairs or the actual cash value of your vehicle if it is deemed a total loss. However, keep in mind that collision coverage typically comes with a deductible, which is the amount you’ll need to pay out of pocket before the insurance kicks in.

-

Comprehensive Coverage: Comprehensive coverage is designed to protect your vehicle against non-collision incidents, such as theft, vandalism, fire, or natural disasters. It provides coverage for the repair or replacement costs of your vehicle, minus the deductible. Comprehensive coverage can be especially beneficial if you live in an area prone to extreme weather conditions, high theft rates, or other potential risks.

By understanding the different types of car insurance coverage available, you can ensure that you have the right level of protection for your vehicle. Consider your needs, budget, and the value of your car when selecting the appropriate coverage options. Remember, it’s important to review and update your coverage periodically to ensure you have adequate protection as your circumstances change.

Tips for Getting the Best Car Insurance Deal

-

Comparison Shopping: Before settling on a car insurance policy, it’s important to shop around and compare different options. Take the time to request quotes from multiple insurance providers to make sure you are getting the best deal possible. Keep in mind that while price is important, it should not be the only factor to consider. Pay attention to the coverage offered, deductibles, and any additional benefits or discounts.

-

Understand Your Needs: To find the best car insurance deal, it’s crucial to understand your own needs and requirements. Consider factors such as your driving habits, the value of your vehicle, and the level of coverage you feel comfortable with. By having a clear understanding of what you need from your car insurance, you’ll be better equipped to make an informed decision and find the policy that suits you best.

-

Consider Bundle Deals: Many insurance companies offer bundle deals that include multiple types of insurance, such as home and auto insurance. Combining your insurance policies with one provider can often lead to significant savings. So, it’s worth considering bundling your car insurance with other insurance needs you may have in order to get the best overall deal.

Remember, finding the best car insurance deal takes time and effort, but it’s worth it to protect your ride and your wallet. By comparing quotes, understanding your needs, and exploring bundle deals, you’ll be on your way to securing an insurance policy that provides the coverage you need at a price you can afford.

Car insurance is a vital aspect of owning and operating a vehicle, providing protection for both your beloved ride and your hard-earned money. But for many, navigating the world of car insurance can be daunting and overwhelming. It’s important to understand the ins and outs of this essential coverage to ensure you make informed decisions…